🇺🇸 Do Tariffs Help or Hurt? A Deep Dive Into Trump’s Trade Proposal, Economic History & What Comes Next

Dan Stratford Asks ChatGTP

🧭 Introduction

With Donald Trump proposing a universal 10% tariff on all imports—and a 60%+ tariff on goods from China—Americans are again asking:

- Will this bring jobs back?

- Will it protect our economy?

- Or will it raise prices and start trade wars?

This blog explores what happens when tariffs are raised, drawing on historical context, economic theory, real-world examples, and forecast data to determine:

- What good can come from raising tariffs

- What bad outcomes typically follow

- Short-term vs. long-term effects

- Sector-by-sector analysis

- Global case studies of successful and failed tariff policies

- When tariffs actually work

🔍 Part 1: The Pros and Cons of Raising Tariffs

✅ Short-Term Benefits

- Protects domestic industries by making imports more expensive

- Saves jobs in vulnerable sectors like steel and aluminum

- Generates revenue for the government at ports

❌ Short-Term Risks

- Higher prices for consumers on everyday goods

- Disrupts global supply chains for manufacturers

- Triggers retaliation from trade partners (e.g., China, EU)

✅ Long-Term Potential Gains

- Encourages domestic investment and supply chain resilience

- Strengthens national security by reducing dependency

- Improves leverage in trade negotiations

❌ Long-Term Threats

- Industries may become complacent and inefficient

- Tariff-induced inflation reduces consumer purchasing power

- May harm diplomatic relations and global competitiveness

📚 Part 2: What History Tells Us

| Policy | Short-Term Result | Long-Term Outcome |

|---|---|---|

| Smoot-Hawley (1930) | Massive retaliation, exports dropped | Deepened the Great Depression |

| Reagan Tariffs (1980s) | Saved Harley-Davidson, pressured Japan | Led to Japanese FDI in the U.S. |

| Bush Steel Tariffs (2002) | Short boost to steel, hurt other industries | Rescinded after WTO ruling |

| Trump-China Tariffs (2018–2020) | Hurt farmers, raised input costs | Mixed: some reshoring, no major concessions |

🏭 Part 3: Sector-by-Sector Impact

- Manufacturing: Short-term gain for steel, long-term growth if supported

- Auto: Short-term loser, potential winner if EV sector is reshored

- Agriculture: High exposure to retaliation, export loss

- Tech: Short-term disruption, CHIPS Act could help long term

- Construction: Costs rise on materials like steel and lumber

- Retail: Consumer prices increase; niche US-made goods may benefit long term

🌎 Part 4: Global Case Studies

| Country | Strategy | Outcome |

|---|---|---|

| USA (1800s) | Tariffs funded government, protected industry | Led to industrialization |

| Germany | Tariffs protected steel/farming under Bismarck | Helped industrial expansion |

| South Korea | Protected infant industries while promoting exports | Created global brands like Samsung |

| Taiwan | Gradual opening after protectionism | World leader in semiconductors |

| China (pre-WTO) | Protected industry before WTO accession | Gained manufacturing dominance |

| Brazil | Tariffs used in ISI strategy | Built aerospace (e.g., Embraer) |

| India | Protected economy post-independence | Some success, liberalized in 1990s |

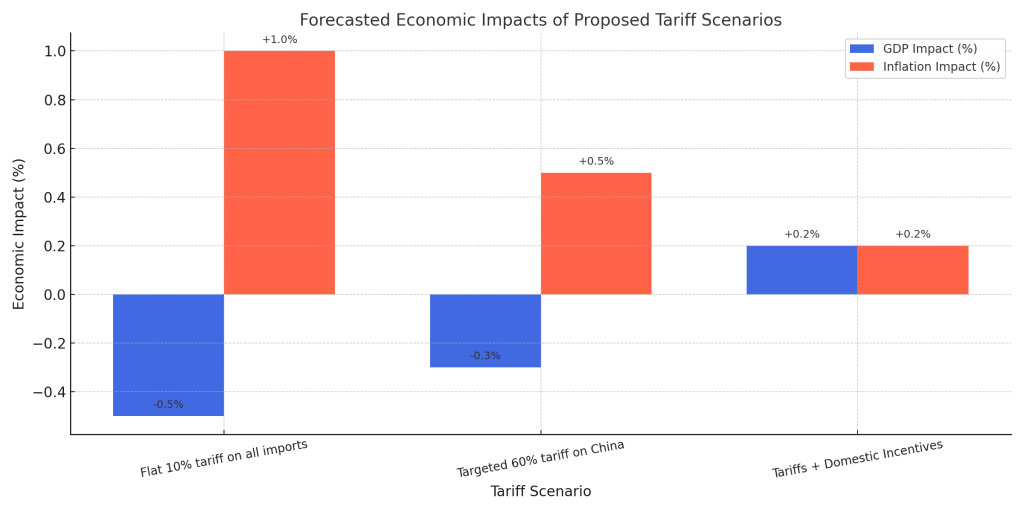

📊 Part 5: Economic Forecasts of Tariff Scenarios

| Scenario | GDP Impact | Inflation | Net Jobs | Trade Balance |

|---|---|---|---|---|

| 10% on all imports | -0.5% | +1.0% | -250,000 | Short-term improvement |

| 60% on China | -0.3% | +0.5% | -100,000 | Moderate improvement |

| Tariffs + Investment | +0.2% | +0.2% | +150,000 | Improves over time |

🎯 Part 6: When Tariffs Work

- Targeted and time-limited

- Paired with domestic incentives and innovation

- Used during trade imbalance or foreign dumping

- Supported by diplomacy and reinvestment

🏁 Conclusion

Tariffs are a policy tool—not a silver bullet. Used properly, they can protect key industries and spur growth. Used poorly, they raise prices and provoke retaliation.

Tariffs + Strategy = Potential Growth

Tariffs Alone = Economic Risk